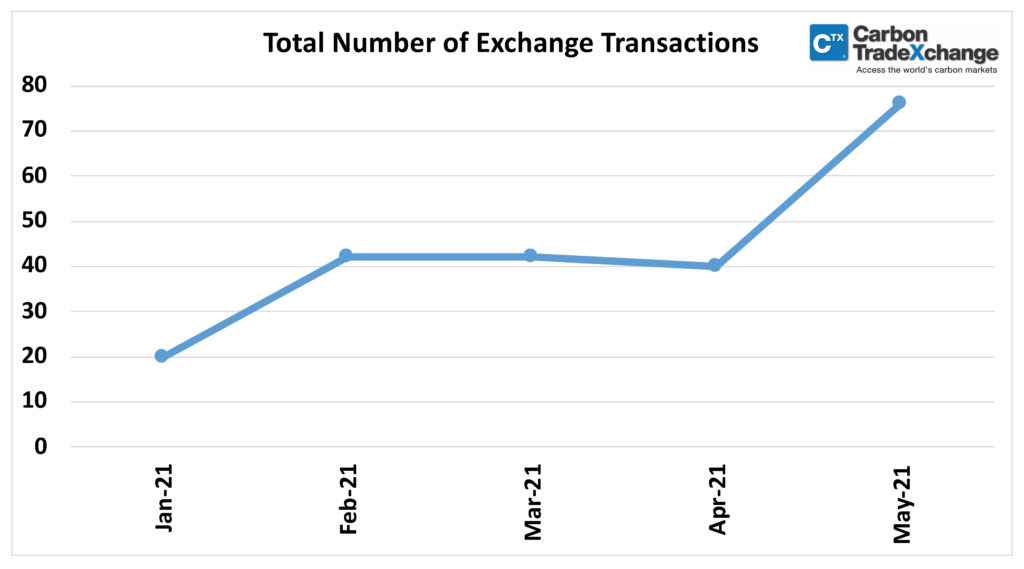

What a huge last three months we have seen in the carbon offsetting markets. With HUGE buyer interest in the market, we have seen a massive run on lower priced credits (under US$2/tonne), which has seen prices driven up and inventory being snapped up at rates that we have NEVER seen before. After over a decade in this space, these are the days that most projects had been dreaming would come. As most of you will be aware, this is a market that for most of its existence has been buyer led and driven and dominated by OTC Brokers. Suddenly there has been a huge swing towards overheated demand and exchange trading that has happened in just a couple of months. This means buyers are now finding it far more difficult to find specific project, methodology or credit types in reasonable volumes and especially at prices that are within corporate budgets. But the buyer market is still Voluntary, so if project developers ‘sit’ on credits waiting for another peak – it may not come. Taking some profits today, believing that next year’s credits MAY be worth more is smart business – and our corporate buyers on CTX tend to purchase what they can see NOW. As they also tend to buy in portfolios, most corporates will buy a combination of some lower priced and some more expensive ‘charismatic’ credits, meaning we have seen average prices rise from last year. Subscribe Past Issues Translate RSS Remember also, that CTX is a wholesale market (and broker) with average transaction sizes between 30,000 and 40,000 over the past 2 months, despite numerous micro 100 ton trades (our minimum).

Forward Purchase - a trap or a treasure?

Many project developers think forward purchase agreements are the answer to their prayers. But many have regretted them because they are stuck with one buyer when the contract expires and there is no market for their credits. As well as this, the buyer is taking a decision based on their expectation that prices will be higher in the future – profits the project has therefore surrendered. As a buyer you are then taking a risk on the delivery (obviously) in an unregulated market, so who is actually buying PERs or PIUs or other ‘forward’ contracts? For example from the data we have seen, it looks like PERs are being sold to mostly Small Businesses by project owners with their own Broker operations. CTX are investigating the possibility of listing them on our exchange in the near future. Is there an interest in this? Let us know your views:

Another issue that arises, is when does a forward purchase become a ‘Futures’ contract? Does this make it a ‘Regulated Instrument’? Investopedia defines a futures contract as “a legal agreement to buy or sell a particular commodity asset, or security at a predetermined price at a specified time in the future. Futures contracts are standardised for quality and quantity to facilitate trading on a Futures Exchange”.” The scale of commoditised trading on those futures exchanges is vastly different to our Spot Market Exchange, as is the cost of participation as a buyer and seller on those exchanges. Many recent emerging entrants into the Voluntary market are touting commoditisation and ‘forward’ purchase’ contracts, but there’s a real risk that we enter into a new uncharted territory that actually could exclude most of the current market participants from the ‘Scaling UP’ process they purport to be supporting. CTX will stick to what we do for now, but we are always interested in hearing from our network, so let us know your thoughts.

CTX Technology and Security Upgrade - June 2020

For the past 3 months CTX has been working with a major Global Investment Bank to design and build an advanced version of the CTX exchange technology which can allow Multi-Factor Authentication (MFA) for accounts access or trading, the feature which will be released mid-June. MFA will be at the discretion of the principal account holder (Designated Authorised Representative or DAR) so for those who wish to use the current email password sign-on, they will be able to do so. However, each CTX member will be advised when they will be required to resubmit a Mobile number/Email address at least once for authentication, which would then be used if they select MFA in the future. ‘protocol’ and secure URL inbound access for large Global Corporations or Banks.

Finally, GEM the CTX Parent is well advanced in terms of Blockchain interface for pre and post trade DLT input for credits from Blockchain DLT Registries and post trade into multi asset trading platforms with other Digital Assets such as Security Tokens. But don’t confuse this with Crypto Tokens with no asset behind them.

Crypto Carbon - burning a hole in... ?

As the coverage of the carbon markets has been so extensive in the media recently, CTX has been bombarded with new start-up ideas from tech ideas, to trading

‘platforms’ and mostly Crypto/tokenisation. CTX is receiving multiple enquires each week, but it’s time to do a high-level review. The first thing, is a Crypto Token is (supposedly) an investment wherein it could be worth more in the future (or less if timing is wrong). A Carbon Credit is created against already proven emissions reductions or sequestration in order to be sold as an Offset against a company’s (or via reputable brokers’ personal) emissions footprint. To create an offset, the Carbon Credit is cancelled (retired), meaning it has no further value other than its marketing, or in some cases, tax benefits. So, unless they intend to somehow hold a carbon credit long term against every Token issued, any Token issues against a carbon offset it would have to be BURNED (that’s the actual Crypto term for cancelling a Token), then new Tokens issued for the next issue of Carbon Credits and the energy use in this model would likely effectively negate the environmental benefits. To be clear, CTX does not sell Carbon Credits for Investment and only companies (not individuals) may join.

In Summary: the more ‘layers’ between the ‘instrument’ or Token and the actual core Carbon Credit, the easier it is to bamboozle buyers. So far we haven’t discovered one we would buy.

Slowed Issuances in Jan/Feb

Feedback from many Project Developers indicates that all the major voluntary credit standards experienced layers of delays in issuance with lots of strategic distraction, largely driven by unsubstantiated allegations of credit valuation, ‘validity’ or credibility, driven, in our view, by vested interests. Unsurprisingly a flurry of new Credit Standards have ‘popped up’ – all purporting be claiming to issue “High Quality” credits in the future – based on the same or similar principles to the proven standards at UNFCCC CDM, Gold Standard or Verra VCS. No less than 10 recent credits standards have applied for CORSIA approval – despite no serious evidence of Airlines actually buying in meaningful quantities, for obvious reasons. largely plagiarised existing programs, some of these newcomers may be simply trying to use that ICAO recognition – if they get it – to ‘shoehorn’ into the existing developers. CTX does intend to expand its portfolio of Credit Standards in the near future, based off a rigorous overview of the Credit Standard, its actual track record, plus the Registry in which the credits are housed and who controls it. Historically CTX was connected to up to 8 Registries simultaneously, which all the 12 Credit Standards were recorded centrally in the CTX Meta-Registry embedded in the CTX Exchange technology. That list today is smaller for very good reasons. But watch this space for a small number of additions in June/July

Project of the Month 1: Nii Kanti Project, Peru VERRA VCS 8 SDGs

The Nii Kanti Project works with seven different indigenous communities to conserve 119,837 hectares of threatened forest in the Peruvian Amazon. By the end of 2021, this project will have reduced global emissions by 2.7 million tonnes, equivalent to taking 726,000 cars off the road. Deforestation is prevented through developing sustainable alternative land use and also through better land and forest management. Other community benefits include:

- Local people trained on land governance and conflict prevention and resolution.

- The project has Increased patrolling, surveillance, and financing of urgent actions for land and forest management relating to boundaries which aims minimize conflicts with land invaders.

- Over the project lifetime, over 2,000 women and over 550 families will have improved their livelihood

- Many jobs created and over 350 families directly involved with improved incomes.

This small hydropower run-of-river project based in Uganda is working to generate renewable electricity to the Ugandan electrical grid. By harnessing water from the Ishasha River and running it via two turbines in the powerhouse, electricity is directly transmitted to the Uganda Electricity Transmission Company Limited

(UETCL). The electricity produced is clean and affordable, directly enhancing local economic and environmental sustainability. This clean energy will replace

- Reduce Uganda’s energy deficit

- Improved energy security

- Improved air quality

- Create local employment opportunities

- Improved local livelihoods and economic stability

This project will produce 31,596 MWh3 of renewable electricity annually, and therefore will reduce approximately 21,084 tCO2 in emissions per year.