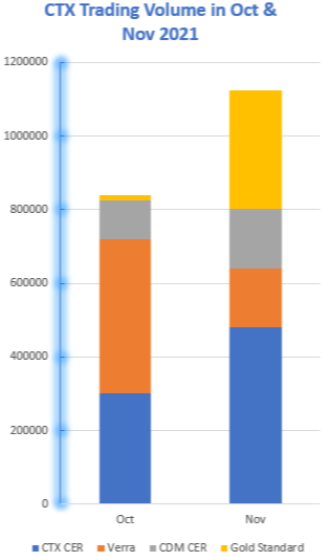

With a number of large institutional buyers ‘hoarding’ credits from Verra VCS and Gold Standard like Scrooge – it seems it is up to ‘Uncle CDM’ to give project developers the gifts they deserve. Given CTX is a market for genuine Offset buyers (3rd parties) in the absence of what they think are their preferred offsets they will often accept what we can deliver. For now the CTX Index only shows the last trades (being updated soon) and does not show the exponential rise in credit sales, or the incredible liquidity we have seen lately where inventory has been on the exchange for less than 24 hours before selling, and sometimes sold minutes after listing.

So suddenly CDM CERs and CTX CERs -outside the CDM Registry – are back in favour after years in the doghouse.

No conversion costs or delays CDM CERs are listed director from the CDM Registry then sold as ‘cancelations’ and CTX CERs transferred under escrow to be sold for transfer or cancellation as Voluntary offsets.

(N.b Australian buyers must have an AFSL to buy CTX CERs for transfer)

Check out our latest blog post soon to be sent out via the UNFCCC CDM Registry

https://ctxglobal.com/carbon-trade-exchange-ctx-global-central-hub-for-selling-wholesale-cers/

COP26 'It's like we thought'

We won’t bore you with more updates on the COP26 outcomes – because the wiser smarter people at Gold Standard did it for us (winning)

https://www.goldstandard.org/blog-item/post-cop26-%E2%80%93-reflections-article-6-outcomes and so did IETA

https://www.ieta.org/resources/Resources/COP/COP26-Summary-Report.pdf and of course Verra VCS did as well

https://verra.org/moving-forward-together-verras-reflections-on-the-cop26-outcome-in-glasgow/ and of course so did the UNFCCC

https://unfccc.int/conference/glasgow-climate-change-conference-october-november-2021

If you did READ all of that (and haven’t lost the will to live) … here is the short version.

First its clear that Nations ‘got the message’ about their own registries and over the next 1-2 years that’s going to escalate – which means the issues relating to double counting and Voluntary credit issuance outside the countries are going to put many credit standards under increased pressure. Its highly unlikely that any country would ‘invalidate’ any already issued credits via the major Voluntary credit standards, but they can – under the Paris Agreement- control future issuances. So, on the one hand certain new credit standards ‘popping up’ who aren’t approved by their host government might struggle going forward.

But let’s not forget there is always the option to ‘covert’ credits by cancelling issued credits and/or future issuances and using the same or similar documents to issue them into a new National Carbon Registry. Cleary many project developers have been doing this in recent years by ‘converting’ CERs to GS or VCS.

Wheat became VERY clear at COP26 is that global electronic trading of Carbon Credits is the next big thing (yawn), and open transparent pricing is crucial (so last decade for us), and that Carbon Credits will finance the whole ‘let’s save the planet’ thing we are in this for AND each National needs its own ‘electronic National Carbon Registry’ (SURPRISE !) , and International finance will use Article 6 to do it.

So in the next 2-3 years ITMOs are the new Carbon Credit everyone will want and $gazillions will trade – so the fact that GEM has a Registry for that and …. CTX Rules? I feel like we invented Jeans or Bikinis. Happy Days ahead.

Finally, we can say is that GEM and CTX went BIG in Glasgow as major sponsors of the IETA Business Hub and after 2 weeks of intensive effort we handed out over 10,000 pieces or promotional material and brochures. If CTX members didn’t get your Mouse Mats, pens or lapel pins give us a shout and we will send by mail. And CTX Project members can look forward to regular insights on how the market is shaping up.

International Carbon Registry - the New boys shine

The new boys (and girls) on the block have a cracking High Quality Credit Standard and have signed up multiple international projects already, and the first credits are issued. They are truly ‘open for business to issue international Credits worldwide – and do not let the low-cost fees fool you – this is a world class Credit Standard that will be a benchmark in years to come. Fully linked to CTX (of course) -we eagerly await the first credits to be listed and sold.

Check them out https://carbonregistry.com/

Request for Offer – Buyers it’s Easy to ask for what you want

The CTX ‘Bid’ Button is being converted to what it really was and is – a Request for Offer. This is how you can let the seller side of the market know what you’re looking for buy without disclosing who you are to get loads of emails or calls. Simply login, complete the minimum information and Post the Offer and its there for all to see – then when it matches (or close to it) our team at CTX will contract you to help execute the trade on the exchange- TOTALLY confidential. This is NOT a ‘Hit the BID’ function because as we all know the parameters in the Voluntary market has too many variables- so the buyer must always ‘aggress’ the trade in CTX and be in funds to buy .

Line of Credit Trades and CTX Forward Purchase

Recently we have had some VERY large trades done under the CTX unique Line of Credit (LoC) . As the market has heated up a LoC is only granted to an established CTX buy side client, with proven payment and transaction history, who has provided us a proven bank transfer to execute the trade. Project developers & Credit owners may have been surprised to see a ‘Pending Transaction’ email, then 24-48 hours later a Settled Trade notification email and trading statement.

These Trades are Cleared and Settled automatically as soon as the funds arrive and if they don’t – within 2 working days the Credits are immediately relisted onto your account as before. There hasn’t been a default trade and we don’t expect one – but the sellers’ credits are NEVER at risk. Trading at scale means innovation!

Global Environmental Markets signs multiple new Registry Deals

On the back of our COP26 adventures Global Environmental Markets (“GEM”) and its wholly owned Carbon Trade eXchange (“CTX”) was a Partner of the International Emissions Trading Association (IETA) COP26 Business Hub

GEMs National Carbon Meta-Registries are Paris Agreement compliant, and we have now multiple Registry deals signed from Southern Africa to the Philippines and soon South America, the Middle East and many more.

In 2022 GEM & CTX are going to rock your world!

Project on the Month #1

The Envira Amazonia Project

A Tropical Forest Conservation Project in Acre, Brazil VCS1382

This month we focus our spotlight on the plight of the Amazon rainforest which is on course to be reduced to 75% of its original extent by the 2030s.

Although still large, this may prove to be a tipping point for the Amazon, triggering a phenomenon known as FOREST DIEBACK. The forest becomes suddenly unable to produce enough moisture to from its diminished canopy to feed the rainclouds, and the most vulnerable parts of the Amazon degrade firstly into a seasonal dry forest, then an open savannah. This decline is self-feeding- the more the dieback occurs, the more it causes further dieback. The drying of the entire Amazon basin is therefore predicted to be swift and devastating.

The biodiversity loss will be catastrophic – the Amazon is home to one in ten of all the world’s known species, meaning countless localised extinctions that would trigger domino effects throughout the ecosystem. All wild populations will be hit hard, each individual finding it more and more difficult to locate food and a mate. Species that may have yielded new drugs, foodstuffs and industrial applications may be gone before we knew they existed.

Investing in our project of the month will help allow the Amazon to continue the greatest environmental services it has been providing by locking away more than 100 billion tonnes of carbon in its trees.

This REDD+ project aims to reduce GHG emission by avoiding planned deforestation over private lands occurring by the conversion of forest land to a cattle ranching operation.

The Envira Amazonia Project seeks to help protect and conserve tropical forest by providing payments for ecosystem services. This type of project is known as a Reducing Emissions from Deforestation and forest Degradation project (REDD+ project). This project is being developed and registered under the Verified Carbon Standard (VCS) and the Climate, Community and Biodiversity Standard (CCBS) – CCB Gold.

Project development involved engaging a large landowner willing to forgo conversion of forest land to a ranching operation, working with the local communities surrounding the project area, engaging Acre state officials working on reducing deforestation pressures on the regional/state level, and putting into operation the REDD project implementation plan with the help of local partners. The Envira Amazonia REDD APD Project will generate GHG emission reductions by foregoing forest conversion to grassland in favour of conservation of the tropical forest (i.e., maintaining existing carbon stocks).

The project will also mitigate deforestation pressures in the wider region using a combination of environmental programs and social programs intended to improve the livelihoods of community members living in the vicinity of the project area. Social projects and programs for the local communities will not only generate sustainable economic opportunities, but will also result in a reduction in deforestation in the region and the preservation of biodiversity.